Essential Finance FAQs for First-Time Truck Buyers

Tuesday, August 20, 2024

Navigating the ins and outs of truck finance can be daunting for first-time buyers. From understanding the different types of truck loans to finding the best rates, first-time buyers have a lot to consider, and a lot riding on their decision.

But daunting doesn’t need to be difficult. At Credit One, we’ve helped hundreds of first-time buyers secure finance, and know a thing or two about the questions that are probably running through your head. In this article, we’ll take you through the most common questions and queries we get from first-time buyers looking to finance their first commercial truck, so you can make an informed decision and find the right truck to suit your needs.

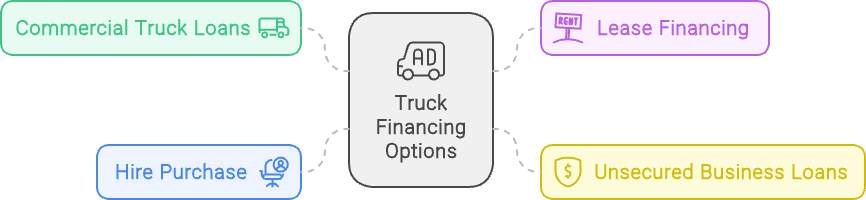

What are the different types of truck loans available?

There are a range of truck financing options available to first-time buyers – which one you choose will depend on the needs of your business and your financial position. Let’s dive into some of the options so you can see what the best fit might be.

Commercial Truck Loans

Commercial truck loans are specifically designed for purchasing trucks and commercial vehicles. Commercial truck loans offer longer repayment periods to reflect the long service life of a commercial truck, and are usually secured against the truck itself, as it tends to hold its value well. For these reasons, commercial truck loans are a solid option for businesses looking for ownership of their vehicles from the start.

At Credit One, one of our primary forms of commercial truck loans is a chattel mortgage, where the truck serves as collateral for the loan, which is repaid in structured monthly instalments. At the end of the repayment period, the borrower (that’s you) takes clear title to the vehicle, and is free to sell it or keep it in service.

Lease Financing

Lease financing (or a finance lease) offers more flexibility than a chattel mortgage, allowing businesses to use the truck for a predetermined period without owning it. There are three main options when it comes to leasing: a finance truck lease, an operating truck lease, and a fully maintained operating truck lease.

Finance truck lease

A finance truck lease is a standard lease agreement where you make fixed monthly repayments, with a residual or balloon payment at the end of the lease term. The interest rate is fixed, making it a great option for businesses that require predictable cash flow management, and once all payments (along with the balloon payment) have been made, you take full ownership of the truck.

Operating truck lease

An operating truck lease is designed for businesses that regularly upgrade their fleet. Like a finance truck lease, an operating truck lease has a fixed interest rate to allow for predictable repayments, and at the end of the term, you have the option of returning the truck to the lender or purchasing it at market price.

A defining feature of an operating truck lease is that it is off-balance-sheet for the borrower, meaning it appears on the lender’s books, making it a great option for businesses that need to manage their debt levels carefully.

Fully maintained operating truck lease

A fully maintained operating truck lease is very similar to an operating truck lease, but has all the truck’s running costs – maintenance, fuel, registration – included in the monthly repayments. Whether it’s for cash-flow management or the sake of simplicity, these leases are perfect for businesses that like to have every dollar accounted for, with no unexpected costs.

Unsecured Business Loans

Unsecured business loans are another form of finance that allow you to purchase a truck without needing to post collateral. While this may seem like a dream come true, it is important to keep in mind that unsecured business loans have higher truck finance rates in order to offset the lack of collateral and the risk to the lender, leading to higher repayments and a larger interest burden over the life of the loan.

Despite this, unsecured business loans are a viable financing option and are a great way for new businesses that are asset poor to enter the industry without the roadblocks of collateral.

At Credit One, we do our best to offer unsecured business loans that are tailored to the unique needs of your business. From customisable loan terms to early repayment options, we pride ourselves on our flexibility, and have helped many first-time buyers get their start in the industry through a carefully designed unsecured business loan.

Hire Purchase

Hire purchase arrangements let you pay for the truck in instalments while using it, with the plan to own it outright at the end of the term. This method is a hybrid of leasing and owning, ideal for businesses that expect to keep the truck long-term without the upfront capital expenditure. Although we do not offer hire purchases at Credit One, many lenders still do, and they can be a valuable financial tool for the right business.

How do I apply for a truck loan?

Applying for a truck loan involves several key steps to ensure you find the right financing solution for your business. Start by assessing your needs to understand what type of truck fits your business operations and budget. Checking your credit score is crucial as it significantly influences the loan terms and rates you can secure.

Gathering the necessary documents such as business financial statements, proof of income, and identification is essential for the application process. Next, choose a lender by comparing offers from banks, credit unions, and specialised truck finance brokers to find the best terms. Finally, submit an application with all required documentation and any additional forms the lender requires.

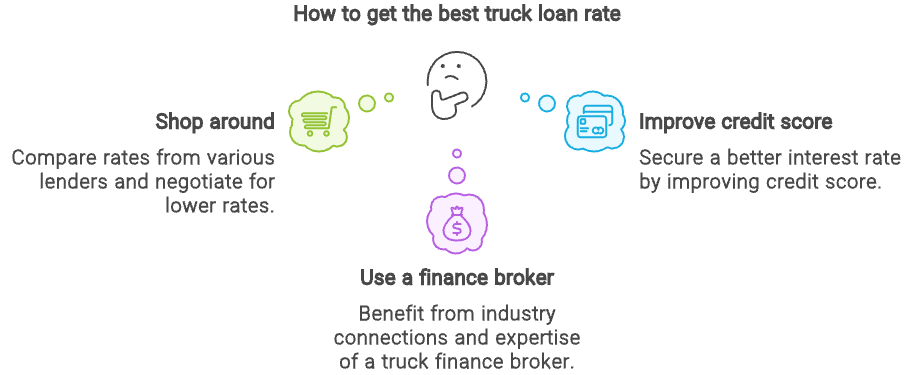

How can I find the best truck loan rates?

Securing the best rates on your truck loan requires some diligence and patience. As with any loan, your best chance at getting a good rate spend some time shopping around different lenders to compare rates and see who offers the most competitive terms. Once you have a number of quotes, you can use them to negotiate with lenders and try to secure a more favourable rate or more generous terms to the loan.

When it comes to the loan itself, a high credit score will do more than anything else to get you a good interest rate, as lenders use this as a measure of your reliability, and will offer less favourable rates to borrowers with bad credit.

Whether you’re getting ready to apply for truck finance or are some months (or years) away, taking the time to improve your credit score is one of the best pieces of preparation you can do. Start by paying down any existing debts you have as quickly as possible and closing any unnecessary lines of credit, and ensure your everyday financial obligations – rent, power, internet etc – are paid in full and on time every month.

The aim of all this is to show your responsibility and reliability as a borrower, and nothing spooks lenders more than late bills, outstanding loans, and frivolous access to credit.

Finally, you can consider using a truck finance broker like Credit One. Unlike regular brokers, truck finance brokers have an intimate knowledge of the trucking and transport industries and the unique needs of the businesses and buyers that work in them. Truck finance brokers will often have longstanding relationships with lenders, and can use these in combination with their industry knowledge to negotiate better rates on your behalf – something that can be incredibly valuable to first-time buyers.

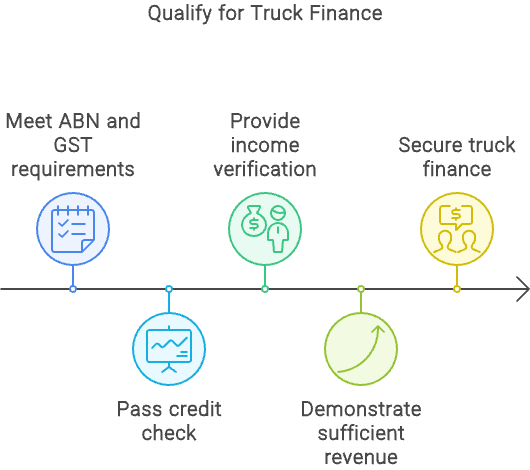

Are there any specific qualifications needed to apply for truck finance?

To qualify for truck finance, there are several common requirements you’ll need to meet. Most commercial truck loans require the business to have an ABN and be registered for GST. Your credit history will be scrutinised to assess your risk as a borrower, so having a solid credit score or a track record of reliable financial behaviour can be crucial.

Income verification will also be necessary to demonstrate that your business generates enough revenue to cover the loan repayments. These criteria help lenders ensure that they are extending credit to viable businesses who will be able to repay the loan within the loan term.

What are the typical repayment terms for truck loans?

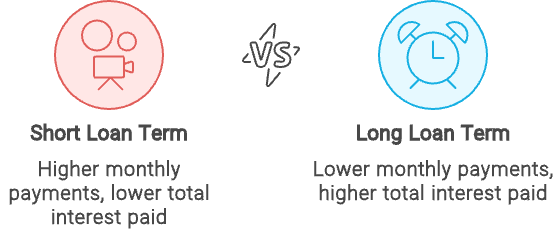

Repayment terms for truck loans will vary significantly depending on the lender and the type of loan you choose. Generally, terms range from one to five years, but they can extend up to ten years or more for larger loans.

While the loan term is set by the lender, you may have several term lengths to choose from depending on your financial position. If this is the case, it’s essential to consider how the length of the term affects both your monthly repayments and the total interest paid over the life of the loan.

It can be tempting to opt for the longest loan term possible to reduce the size of your monthly repayments, but more often that not, this will result in a higher overall cost due to the interest over the life of the loan.

Before you sign on the dotted line, think carefully about what your plan is, both over the life of the loan and beyond it. Are you planning to upgrade your truck in a couple of years, or will this vehicle see you through the next five, or even ten years of your career?

If you’re already thinking of upgrading shortly down the road, it’s a good idea to opt for a shorter loan term so you can get a clear title to the truck sooner, allowing you to sell it on to fund your eventual upgrade. But if you’re early in your career and can see yourself hanging onto your first truck for a while, the lower repayments might be just what you need to help you get started in the industry.

Can I finance a used truck?

Financing a used truck can be a cost-effective option for many businesses, especially those looking to expand their fleet without the higher cost of new vehicles. Although can finance a used truck just the same as a new truck, the terms and rates may differ depending on the vehicle’s age and condition, and lenders will not always be as willing to offer finance when compared to a new vehicle.

For instance, a lender might require a more thorough pre-purchase inspection to be conducted, or ask for additional documentation for used trucks to ensure they are a good investment and aren’t going to fall apart the moment you hook up a trailer.

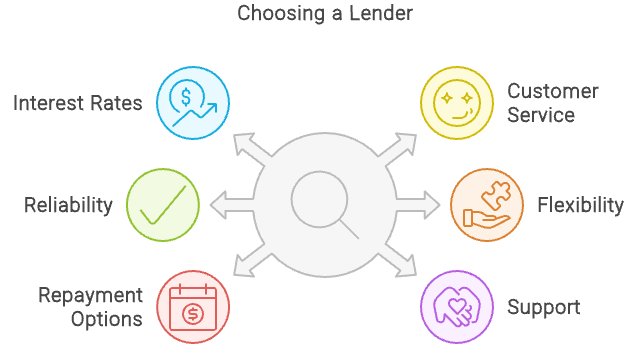

What should I consider when choosing a lender?

Choosing the right lender is about more than just finding the lowest interest rates. Consider the lender’s reputation for customer service and reliability in the truck finance industry, so you can feel confident that you’re working with someone who knows what they’re doing and will work in your best interests, and those of your business.

It is also worth looking at how flexible the lender is when it comes to loan terms and repayment options. The trucking industry can be fickle, and fluctuating cash flow is a reality for many businesses, so having a lender that understands this reality and is willing to work with you when times are tough can be invaluable.

Finally, assess the level of support the lender offers during the loan application process and beyond, as this can make a significant difference in how smoothly your financing experience goes.

Start Your Trucking Career with Credit One

If you’re looking to start a career in trucking, we can help. At Credit One, we offer a range of finance options and truck loans such as chattel mortgages, finance leases, and unsecured business loans that are designed to help new drivers like yourself kickstart their careers.

With extensive access to a broad range of lending providers and competitive interest rates, we make it easy to get your first truck or trailer and get out on the road. Use our truck loan calculator to find out just how affordable financing can be, or contact us for more information and to get a quick quote.

And if you’re wondering what your first truck should be, why not find inspiration by browsing the range of trucks for sale at Only Trucks today!